As soon as they personal those shares, the ask value is determined, taking into account the market fluctuations. The difference between the cost value of the shares and the promoting value is the revenue they make. Though the difference between the ask worth and bid price for each share is low, the shares altogether offer huge income to these market players Proof of work daily. London Inventory Change Group (LSE)The London Stock Exchange Group operates the London Stock Change, which is part of the United Kingdom’s monetary hub.

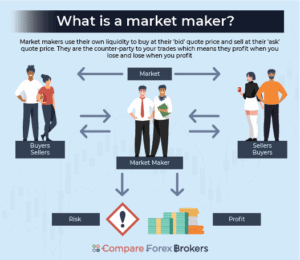

Market Makers Definition

The major perform of the market maker is to reduce volatility and facilitate worth discovery within the stock market by offering a restricted buying and selling vary on the safety they make a market in. The market maker allows for the free move of transactions as a outcome of it will take the other facet of a commerce even when it does not have a buyer or vendor lined as much as full the transaction instantly. While all market makers are liquidity providers, not all liquidity suppliers function as market makers. Each roles play an important half in enhancing market liquidity, with MMs focusing more on continuous quoting and unfold administration.

- These activities contribute to the environment friendly circulate of capital and broader financial growth.

- During intervals of market stress or uncertainty, market makers provide stability by persevering with to supply quotes, even when other market members are hesitant to commerce.

- Market makers assume the chance of holding securities of their stock while profiting from the distinction between the bid and ask prices, generally often known as the unfold.

- Market makers earn earnings through the bid-ask unfold, which represents the difference between the value a market maker is prepared to purchase and the price at which they’re prepared to promote a safety.

- They are also the designated market makers for some securities on the exchanges.

- Market makers earn cash on the bid-ask unfold because they transact so much volume.

Diagram Maker Software Program And Tools Market Share Analysis By Kind And Software

This trend has not only expanded the market attain but in addition increased the adoption fee amongst small and medium-sized enterprises (SMEs). The rising importance of visible information storytelling in marketing, education, and technical fields continues to gasoline demand, making diagram maker software an indispensable asset within the digital age. The industry panorama is characterised by a diverse range of solutions, from easy, user-friendly applications to superior, feature-rich platforms suitable for enterprise-level deployment.

To illustrate, envision an investor observing that the bid price for Apple stock is $60 whereas the ask price is $60.10. This indicates that the market maker acquired the Apple shares for $60 and is now promoting them for $60.10, resulting in a revenue of $0.10. They establish discrepancies between bid and ask costs in different markets or exchanges and execute trades to buy low and promote excessive, capitalising on short-term pricing imbalances. This strategy helps align prices throughout markets and contributes to market efficiency.

Toronto Inventory Trade

Market makers operate and compete with each other to attract the business crypto market makers of traders by setting essentially the most aggressive bid and ask provides. In some circumstances, exchanges may have designated market makers (or specialists), each of whom is responsible for making a market in specific securities. The specialist process exists to guarantee that all marketable trades are executed at a fair value in a well timed method. In financial markets, a liquidity provider contributes to market depth by putting orders to purchase or sell belongings. A market maker is a specific type of liquidity supplier that actively quotes prices on either side of the market, aiming to revenue from the bid-ask spread. As discussed above, the first role of a market maker is to boost liquidity and trading quantity out there.

Meanwhile, much less lively and comparatively illiquid assets will yield wider spreads and comparatively greater “passive profits” for the market maker. On a sensible level, market makers achieve this by constantly quoting buy and promote costs on the property they hold of their stock. Registered market makers are obligated to fill orders from their very own inventory within vary of these quoted prices, offering a certain level of both immediacy and transparency to these transactions. There’s no assure that it will be capable of finding a purchaser or seller at its quoted price. It might even see more sellers than consumers, pushing its inventory higher and its costs down, or vice versa. And, if the market strikes in opposition to it, and it hasn’t set a enough bid-ask unfold, it might lose cash.

Inventory exchanges, brokerage firms, AMCs, and different players depend upon them to improve the general buying and selling state of affairs. Market makers themselves maintain securities to facilitate the activities within the stock market . Since the worth of securities might go down any time, these makers are at risk. To compensate for the danger of holding securities, they’re requested to supply a two-way quote for securities. Market makers are mandated to be keen buyers and sellers at the national finest bid offer (NBBO) for shares they make a market in. They are obligated to submit and honor their bid and ask (two-sided) quotes of their registered shares.

Yes, market makers hold a supply of securities so that they will readily facilitate the buying and promoting of securities; on this https://www.xcritical.com/ means, they preserve liquidity in the market. The inventory needs to be fastidiously managed by hedging as price fluctuations may influence the value of their securities. The spreads between the value buyers receive and the market prices are the earnings for the market makers. Market makers additionally earn commissions by providing liquidity to their clients’ corporations. A dealer is a intermediary who facilitates the buying and selling of securities for buyers, usually on an exchange.

But market makers are additionally capable of go away markets throughout extreme stress, which might contribute to added volatility. Virtu Monetary and KCG Holdings (owned by Virtu) are major electronic market makers. Market makers earn earnings through the bid-ask unfold, a small margin between shopping for and selling prices. • Market makers earn earnings via the bid-ask unfold, a small margin between shopping for and selling costs. PFOF is actually a “rebate” from market makers to brokerage corporations for routing retail purchase or promote orders to them. Previously known as specialists, DMMs are essentially lone market makers with a monopoly on the order flow of a selected safety or securities.

Tips On How To Calculate The Ratio Of A Selling Value To An Asking Price

Their unique place as intermediaries offers useful insights and knowledge into market dynamics, making them key contributors to financial markets’ stability and efficiency. A market maker is an integral a part of the financial markets, providing purchase and promote quotations that allow smooth buying and selling between buyers and sellers. This essential role comes with numerous duties and mechanisms to make sure liquidity available in the market. Market makers quote two-sided markets by offering each bids and asks, together with their corresponding volumes. A bid worth represents the best worth a market maker is keen to pay for an asset, whereas an ask price indicates the minimum price they require to promote it. A market maker is an individual or agency that continuously supplies buy and promote quotes for a particular financial instrument, helping create a marketplace for it.